A total of 616 properties sold in the Victoria Real Estate Board region this September, 15.6 per cent more than the 533 properties sold in September 2018 but a 6.8 per cent decrease from August 2019. Sales of condominiums were up 48.3 per cent from September 2018 with 221 units sold. Sales of single family homes decreased 1.1 per cent from September 2018 with 282 sold.

“September's statistics clearly demonstrate that Victoria continues to have a stable real estate sector and is a desirable place to live," says Victoria Real Estate Board President Cheryl Woolley. “While sales are up compared to the same month last year, our inventory remains low, which may create challenges for people trying to get into the market in certain categories.”

There were 2,823 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® at the end of September 2019, a decrease of 0.5 per cent compared to the month of August but a 6.7 per cent increase from the 2,646 active listings for sale at the end of September 2018.

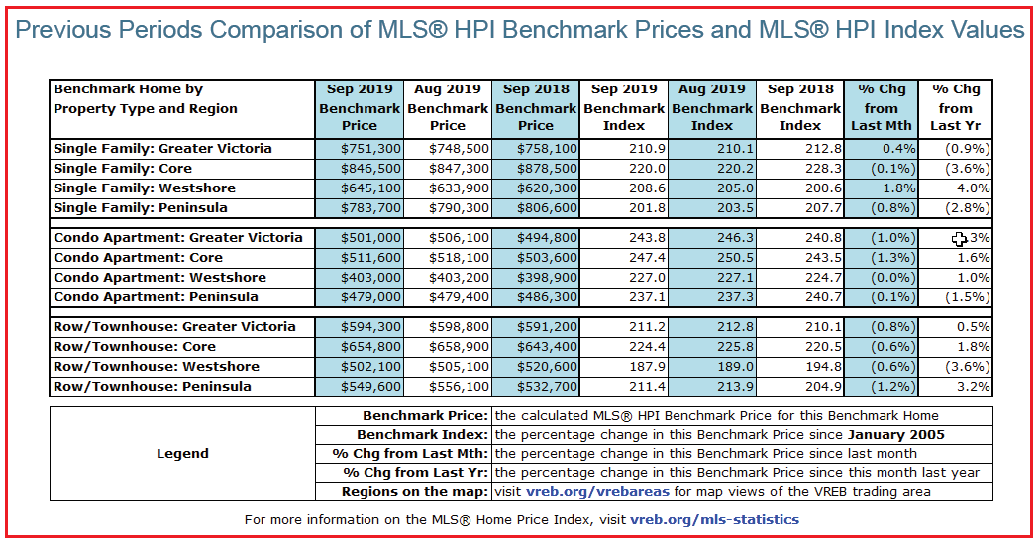

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in September 2018 was $878,500. The benchmark value for the same home in September 2019 decreased by 3.6 per cent to $846,500, slightly less than August’s value of $847,300.

The MLS® HPI benchmark value for a condominium in the Victoria Core area in September 2018 was $503,600, while the benchmark value for the same condominium in September 2019 increased by 1.6 per cent to $511,600, lower than August's value of $518,100.

“We saw increased activity in the condo and townhouse market with an almost 50 per cent year-over year sales increase in condos,” adds President Woolley. “It may be too early to call this a trend towards condo purchases, but this is a number to watch through the fall to see if buyers continue opting for condos and townhomes as more new developments are added to the market in highly desirable locations, with price points often lower than a single family home.”